Get it? Like a riverbank? Anyway:

Cashflow is the #1 killer of businesses.

It is also the #1 grower of businesses.

Cashflow is the flow of money in, and the flow of money out, with the goal of always making more money than your business is spending, and scaling (getting bigger, or more locations) at a sustainable rate. So, here we go!

What Causes Bad Cashflow?

So what is the difference between bad cashflow and good cash flow?

- Good cashflow is having more money than you are spending.

- Bad cashflow is having less money than you are spending.

I know you want to hear about what causes good cashflow, but lets talk about the things I see in real businesses all the time.

These issues are usually caused by the following issues:

- Poor or incomplete documentation (accounting): huge issue with all sizes of companies

- Inconsistency: mostly an issue with smaller businesses

- Scaling without a plan: all sizes of companies

But, but, but, I don’t have any money to grow, because I keep having to pay late fees, and interest because the money doesn’t come in on time!

What Causes Good Cashflow?

Lots of things cause good cashflow. Let’s talk about them.

1. Know Thy Expenses

Accounts Payable = Money Out = Expenses

Three different words/phrases for the same thing, but basically any money your company has to spend.

- Monthly and annual expenses (overhead)

- Capital expenditures (less frequent items, like replacement of equipment)

- Scaling milestones (optimized growth-rate)

If there’s an active hyperlink, I’ve written an article about it going more in depth.

1.1 Make Sure Your Banking is in Order

SET UP SEPARATE ACCOUNTS

Even if you are only making a very small amount of money, SET UP SEPARATE ACCOUNTS. Even if your bank is calling the account Checking 2 and Savings 2, and the money is under your own name, set up the accounts. You need a checking account for cash flow, and a Savings account for taxes.

- Taxes for small businesses

If you are a larger corporation, make sure you work with an industry-specific attorney who can guide you on proper banking practices. A good example of this is property management (apartments):

Certain types of landlords in certain USA states are not permitted to make interest on apartment deposits. But it is (ironically) really freaking hard for an individual or LLC to find savings accounts that don’t pay interest, unless you are a large corporation.

This is something that an attorney would know, but not an unspecialized accountant. Most of these rules apply to persons or corporations holding onto other people’s money.

1.2 Accounting is Like, Really Important

Tone was casual, but all my heart is in it. Poor or incomplete accounting and documentation kills businesses.

Small businesses: you have an excuse: many small business owners are not business professionals, they are makers, artists, coders, and are usually really good at their product or service–but not so good at the business portion. Accounting is really, really important. I can’t even being to explain how important it is.

- Save your receipts

- Have an accounting spreadsheet or software

- Be religious about receipts and mileage

Large businesses: you have no excuse for not recording expenses and income properly–and yet, I find myself lecturing CFOs and CEOs from time to time.

- Have a database of all your revenue information

- You may need to invest in some API stuff (for the database)

- Watch out for conflicts of interest

- Invest in retaining talent

- Be very cautious about what you incentivize

Last but not least: quit making dumb assumptions without talking to the people on the ground.

Looking at numbers without understanding the story behind them is like looking at broken windows, without paying attention to whether the rock was thrown from outside the house or from inside the house.

2. Know Thy Income

Income = Accounts Receivable = Money In

There’s so much to talk about when it comes to income, but lets talk about the actual cashflow first.

2.1 When the Money Comes

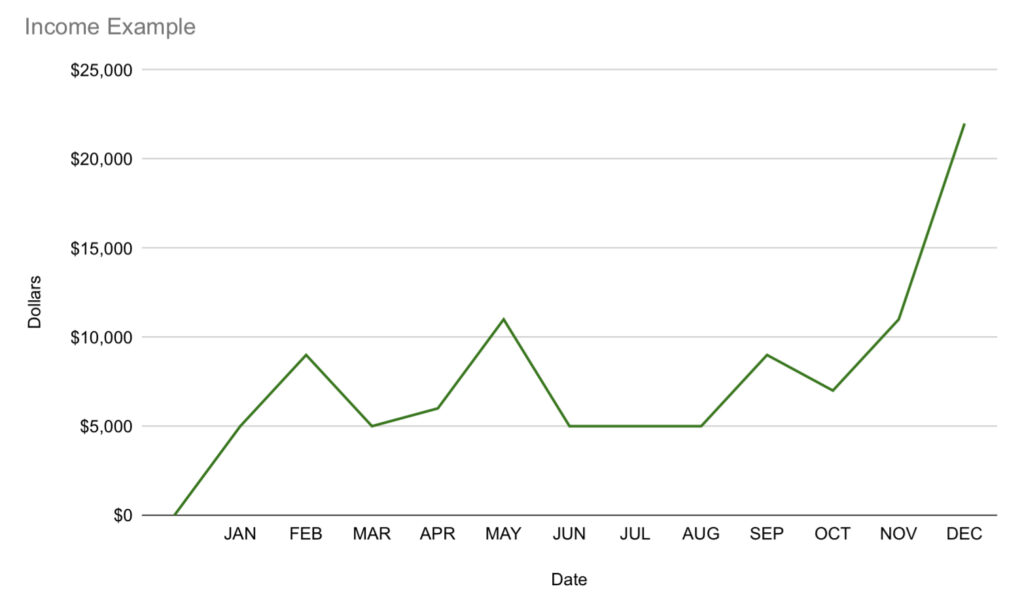

If a US client showed me this chart, I would guess that their main consumers were women aged 35+, probably with children, and folks buying on their behalf, and probably a business selling a physical product; due to the months that there is an income spike.

- November and December is the holiday season, very popular for gifts

- May is a common time for consumer spending to increase: tax returns received in late April, but it also correlates with the US Mother’s Day holiday

- February is the month of Valentine’s Day, a popular month for giving gifts to a lover (especially women)

Why is it important?

A failure to understand your cashflow causes two major problems: 1) spending when the business cannot afford it, 2) investing in the wrong income channels, and 3) not having enough money when big expenses (like annual expenses or CapEx) roll around.

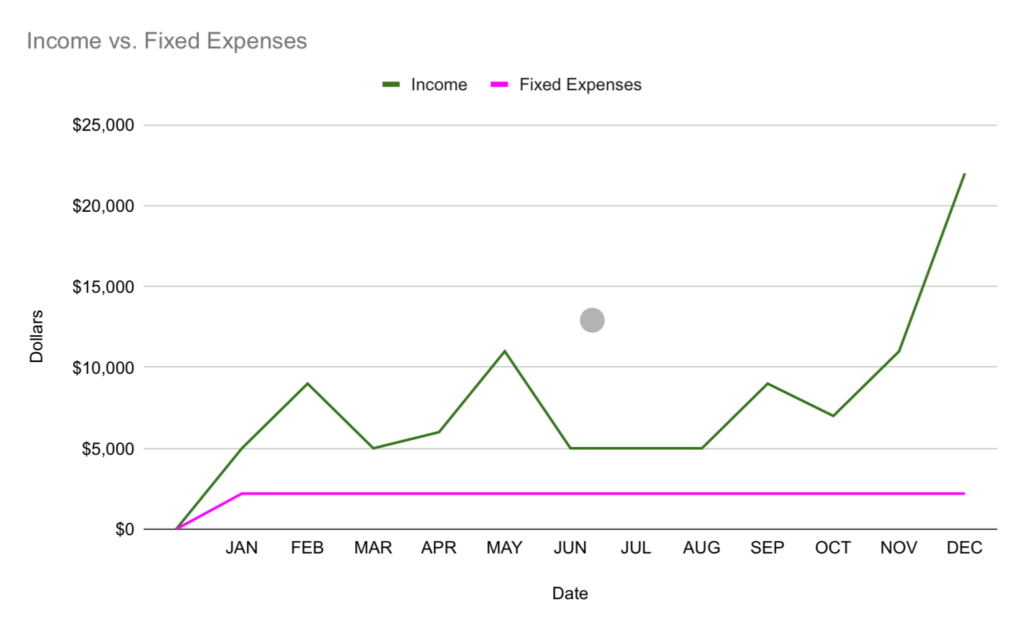

Understanding your overhead is wildly important; imperative, one might say. I’ll write a whole article about this. Overhead is your predictable expenses: fixed expenses (ones that are the same every month), and variable (ones that you can usually make a good ballpark-guess about).

Same income, showing ONLY fixed expenses in pink:

This is a chart of the expenses of my dreams: consistent, predictable, reliable.

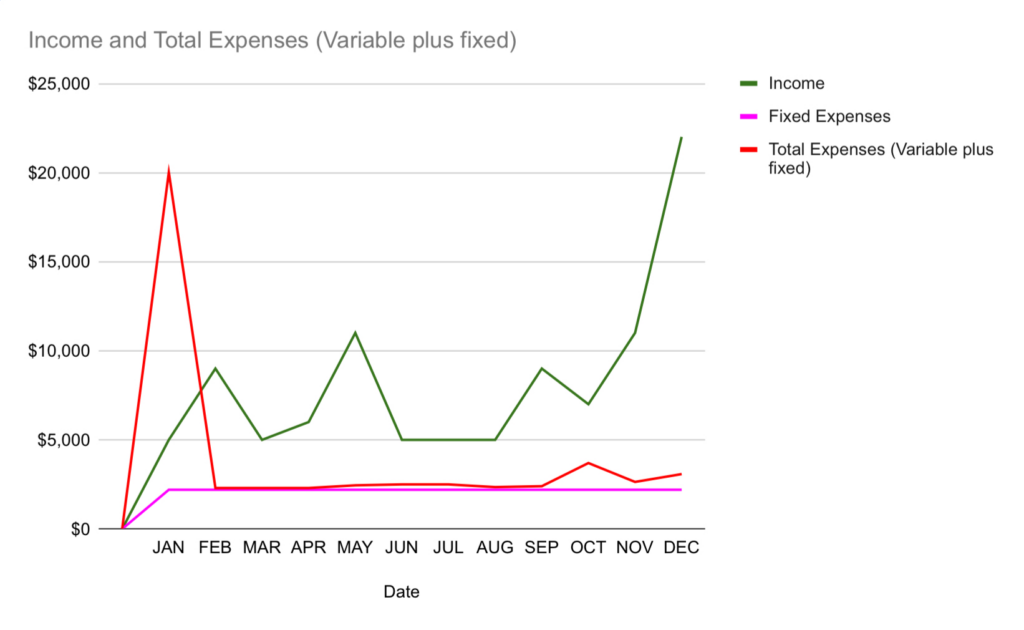

It is of course, not how real expenses work. Here’s a chart showing both fixed and variable expenses together:Varia

- January: taxes are due

- May through July: utilities are higher

- September: technology fees

- October: must purchase more goods or supplies

- November and December: transaction fees are higher, because we are having more transactions

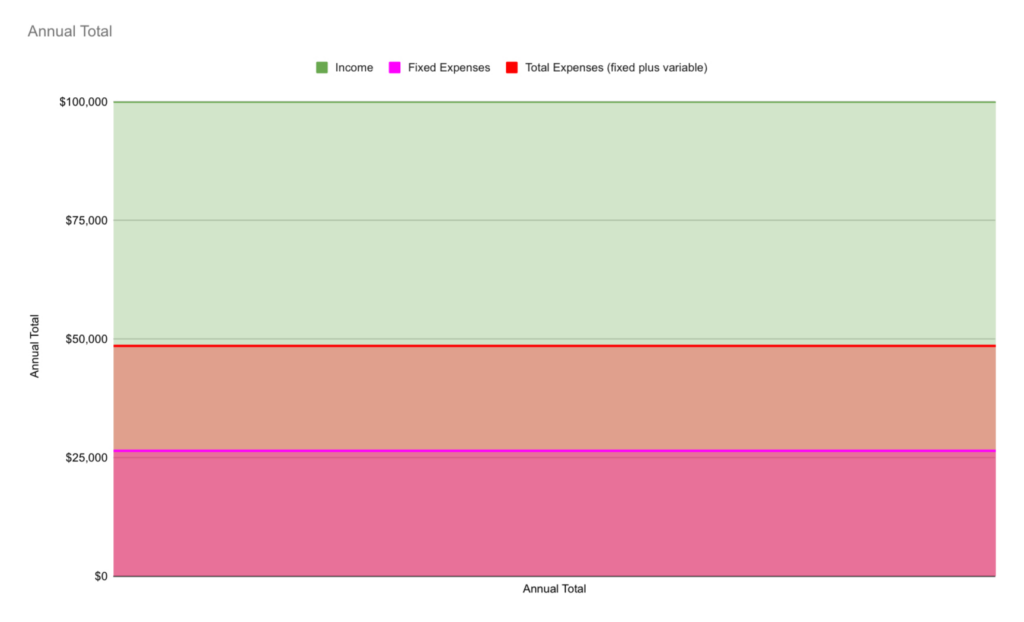

I just know that someone is going to look at the chart above and say that it’s ridiculous, after seeing the taxes spike in January. So here is a bar chart for the year above, showing a comparison of ALL the income compared to ALL the expenses at once–instead of spread out across the 12 months. (Taxes were calculated as if this company makes $100K every year, because I like easy math.)

2.2 Where the Money Comes From

When people talk about income, they talk about the business model. If someone asks you, “What is your business model?”, what they mean is “Where does your money come from?”

2.2.1 What is the Business Model?

Some business models seem straight-forward: restaurants make money selling food, and retailers make money selling stuff–or do they!?

How much money does a Cracker Barrel make from food, versus their gift shop? I know several people in rural towns who drive several miles to shop in the Cracker Barrel Mercantile–and get lunch while they’re at it–instead of the other way around.

Even if the business model is pretty straightforward, make sure you’re paying attention to trends in your business. Some things to pay attention to are:

- What channels are making the most money? A restaurant may make more money from delivery service than from dine-in, and a clothier, even in the most perfect brick-and-mortar location may make more money from online sales than in-person purchases.

- What items have the highest profit margin? Electronics retailers will gross $2K for a large, fancy TV or sound-system–but only net 4%-5% on a transaction like that ($80-$100) whereas batteries and replacement cables, although only a few dollars a piece, may net at 50%-70%.

- A short guide on Profit Margin, Net Income, and Gross Income will eventually link here.

An artist may make $10K on a single giant oil painting, but only sell one per year–the rest of their money is $40K on selling prints, $35K on selling little bought-in-bulk doodads that vibe with their brand, and $5K on coloring books (that only sell in November and December for some mysterious reason).

Larger organizations may have more complex business models: a major-league sports team makes the majority of their money from sponsors paying big-bucks to put their branding on jerseys. The money they make from ticket-sales, concessions, and merchandise–although it may be noteworthy, is rarely a large percentage of their business model–but is a nice bonus, and nothing to scoff at.

The Mercedes-Benz stadium actually loses money on food and concessions to make sure that their huge, gorgeous new stadium is always full–and it’s paid off: their seats are always filled with fans, and (I heard from a reliable source) that they even turned away some sponsorship opportunities. This is called a Loss Leader

The Savannah Bananas is a baseball team who has choreographers on the payroll.

Yes, professional dancers paid to explain and teach dance-moves to professional baseball players. It’s a really cool case-study about customer experience, and digging into defining what makes your brand special, or what your product or service really is. In the Savannah Bananas’ case, they realized that the heart of their baseball team–was truly entertainment. They dance, stiltwalk, and wear silly costumes and the fans love it. Party Animals (a similar team who followed suit) is selling tour tickets for hundreds of dollars, grossing almost as much as some MLB teams.

2.2.2 Embrace Who the Money Comes From

The only organizations I really hate, are companies who don’t embrace their fans. There’s a known phenomenon where individuals or companies will learn that the people who embrace their brand, product, or service, are not who they expected them to be, and “punish” them for it–writers will get rid of favorite characters, manufacturers and makers will discontinue certain colors, service providers will deliver poor customer service to ‘undesirable’ consumers.

(In this context, I’m specifically talking about people who fall into a group: women, seniors, racial or ethnic groups, etc.. I’m not talking about people who act up, or expect luxury services for discounted rates.)

2.2.2.1 Stanley (the Insulated Cup People)

Stanley has been around for literally over a century: they have made excellent, insulated thermos cups designed for contractors and blue-collar workers: construction workers, plumbers, repair techs, etc.

When they noticed women purchasing their products, they started producing them in pretty colors, and increased sales from $70M to $750M.

What is important is that your business pays attention to:

2.2.2.2 Suburu for the Lesbians

There is a stereotype that lesbians always buy Suburus. That’s because Suburu embraced the fact that their cars were becoming popular in areas with large queer communities, including a higher-than-average purchase rate in those queer communities. So they started marketing for the LGBT+ market.

Did they need to? Probably not, their cars are durable and great in snow and rain, but would they have been this successful if they hand’t?

Also probably not.

3. Thou Shalt Plan Well

This advice is mostly for small business owners TBH.

As someone who has greater-than-average skill at understanding and budgeting for scaling, it always upsets me to hear about small business-owners or young companies who fail because they scaled improperly. ‘Growing too quickly’ is a bucket term for several very different problems:

- Over-saturating the market

- Investing in infrastructure or equipment before the income can sustain it

- Increasing overhead and CapEx before increasing income

That doesn’t mean that all debt should be avoided–in fact, there are many very good reasons why debt can be beneficial to your business, but I figure if you’re here to learn what cashflow is, your business probably isn’t quite ready for a talk about when it’s good or bad to take out debt.

3.1 Don’t Over-Saturate the Market

How many pizza places can survive in a ten-mile radius of each-other?

It depends.

In a high-density city like New York or Chicago, there are about a dozen pizza places within walking distance of each other–but every single one has spectacular food. In a low-density town, maybe one or two can survive: because one is owned by everyone’s favorite person, and the other because it has better pizza.

Any product or service can saturate the market. This is all speculation on my part, but I expect A Certain Major Coffeeshop to be forced to make some changes very soon (I write this on Sep 6, 2025) in order to survive.

They have saturated the market, but rather than saying to themselves: “Wow, we saturated all major markets! Expect returns to stabalize.” they are continuing to try to find ways to grow their income, and have attempt to do so by: 1) increasing their prices multiple times in the last year or two (this most recent one was supposedly because of tariffs), and now they are 2) cutting staffing at all their locations down to skeleton crews 3) investing in stupid technology that was developed by execs instead of people who have actually worked in a coffee shop, 4) cutting employee benefits, and making it nearly impossible for their locations to ban unpleasant individuals from their store.

The result is increased prices, poor customer service, disruptive guests that swear at employees and disturb other patrons, and increased turnover. All because they have saturated the market and still want more.

3.2 Beware of Unsustainable Investment

I once knew a guy who invested a bunch of money with the owner of a small farm, so the farm could buy a bunch of refrigerated produce trucks. I was shocked an horrified that he’d invest that much money in such a small business–not because the farmer asking for investment was dishonest or anything–but because I know that sometimes small businesses are tempted to borrow or accept enough money to build their dream-business–without the scale or information to scale.

(The investor guy didn’t even ask to review financials and budgets–looking at financials and budgets will at least give you clue as to whether or not the company is trying to do things right and plan ahead.)

The poor farmer fell into the trap of investing in infrastructure or equipment before the income can sustain it. Had Investor Guy invested enough money for them to buy one produce truck instead of five, they would have been better able to understand the costs associated with such an investment: five trucks need five drivers, five insurance policies, five times the gasoline, five times the maintenance, etc. This small business–which had never owned a produce truck before–bought five trucks, and couldn’t afford all the little costs that came with it, and had difficulty booking out their deliveries enough to make five trucks produce money.

Ultimately, the investor guy lost his entire investment, and the farmer felt horrible about it.

Imagine how dangerous this could be as a business! A small business is full of individuals who are investing their time, money, and the wellbeing of themselves and their families–invest carefully in future infrastructure.

3.3 Scale Carefully

AKA: Increasing Income before (or as) you increase expenses. AKA build a Master Budget to plan far into the future.

Who does this apply to? Any company with overhead.

Scaling is one of my favorite topics (and budgets) because it can look so different from business to business. Whether it’s a one-person business, or a large company.

Super interesting to me because it can really be done starting at $0, depending on the company.

A food-cart can turn into a food-truck which can turn into several food-trucks, which can turn into a restaurant chain. Like Cupbop, for example.

Be very aware of how much overhead and CapEx grow, as you scale. Any company that has a corporate office plus multiple locations is a company that needs to consider this.

I worked for several property-management companies, so I’ll use that as an example:

Whether it is managing Co-ops or HOAs, apartments, mobile parks, or a cabin-communities in the Rocky Mountains–most property management companies have several layers of overhead:

- Corporate Overhead: corporate employees, HR, Payroll, Accounting, execs, taxes, software, customer service, etc.

- Location overhead: on-site employees, maintenance, utilities, etc.

- Location Capital Expenditures: parking-lot replacement, roof-replacement, pool-refurbishing, fencing replacement, etc.

Most of the properties can take care of their own costs for location-overhead and capital expenditures.

Every corporate accountant can handle about ten properties. For every twenty properties, you need to add an HR person and a payroll person. For every fifty properties, you need to add a training and compliance specialist.

The best number to scale at is going to be 20 properties at a time, so that you don’t have under-utilized overhead.

Scaling at thirty properties would add 3 employees to your overhead, but one of the employees would be under-utilized.

- This can also happen with software licensing; some softwares are purchased in tiers:

- Tier 1: 20 licenses or less for $x

- Tier 2: 50 or less for $xx

- Tier 3: 150 or less for $xxx

There is an optimum way to grow the quantity of your locations and departments. A master budget can make sure that your overhead’s output is always optimized.

There ya go.

Thanks for reading, drop any questions, corrections, or special-requests in the comments.

I set up a few spots in this article that I want to link to new, unmade articles–and I’ll prioritize the ones requested in the comments.